Small business owners have had a difficult time securing the funds to run their companies over the last several years. Though the lending market is slowly recovering, businesses that need working capital quickly still may not be able to meet banks’ strict criteria for small business loan approval. Fortunately, accounts receivable factoring is available in every part of the country and for nearly every industry to close the gap between slow payers and available cash.

If you are unable to meet expenses for your small business because of customers that pay as far out as 90 days, Accounts Receivable Cash can help!

The accounts receivable factoring process is simple:

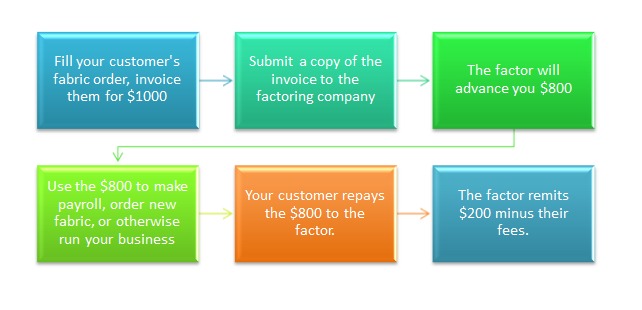

- Perform work for your customers and invoice them as usual.

- Submit copies of your open invoices to the factoring company.

- The factor will advance you a percentage of the invoice value upon approval.

- Use the cash you receive to run your business.

- Your customers will pay the factor directly for their open invoices.

- When the factor receives payment, they will remit your remaining invoice value minus their fees.

Below is an example of how accounts receivable factoring would work for a small business selling fabric to a client who makes custom apparel*:

Unlike a conventional loan, small businesses can repeat the factoring process as often as necessary to maintain steady cash flow. There are several other benefits to companies that pursue invoice factoring over other lending options:

Flexibility – Because factors purchase based on your sales volume, the cash available to you increases as your business grows. With no minimums or maximums to factor, you can control your fees and the money you have on-hand.

Back office support – Your factoring company may handle typical office functions such as credit verification and collections efforts, freeing up your time to stay focused on your business.

Credit building – A traditional small business loan creates new debt on your balance sheet, but accounts receivable factoring does the opposite! Immediate cash means you can pay your bills, take advantage of early-payment discounts, and establish or rebuild a strong credit score that you can later use to finance equipment or supplies.

Approval for poor/unestablished credit – Even if you don’t have a strong credit score, you can still be approved for invoice factoring. Factors base their funding decisions on your customers’ creditworthiness because they will be paying the bills. Your credit is less important because the factor is purchasing the rights to the invoices you factor.

Peace of mind – Small business owners have plenty to worry about and money is usually the center of every concern. By using accounts receivable factoring to finance your business, you can eliminate the largest source of stress and concentrate on continued success.

Accounts Receivable Cash has invoice factoring partners across the United States that can customize a competitive small business factoring program for your company, no matter the industry. If you have open invoices and a list of established customers, we can get you started today and approved in as little as 3-5 business days!

Learn more about Account Receivable Cash’s invoice factoring program for small businesses, then contact us for a same-day quote!

*the figures presented above are strictly for illustrative purposes and do not constitute a quote or offer from Accounts Receivable Cash or Factor Finders.